Introduction

For investors who unfortunately bought into $ALT at its peak price around $0.5xx, the road to recovery seems quite challenging. There are several key factors contributing to the difficulty of reaching previous highs, including the lack of new appeal, disappointing staking rewards, and increased competition. In this article, we’ll dive into these issues in detail to help you understand the current state of $ALT and what to expect going forward.

1. Decreasing Appeal

Previously, $ALT was widely hyped because it was seen as a “beta” version of $EIGEN, attracting significant attention from the community. However, since $EIGEN’s full launch—despite underwhelming reception—$ALT has lost much of its appeal. Investors who saw $ALT as a gateway to $EIGEN have since turned their attention elsewhere, leaving $ALT in a tough spot.

Moreover, $ALT now faces heavy competition in the restaking sector. Projects like $ETHFI, $REZ, and $PUFFER are gaining traction, each offering unique features that make them more competitive compared to $ALT. Unfortunately, $ALT hasn’t been able to stand out in any significant way, which has led to its decline in interest.

Staking Disappointments

Adding to investor frustration, $ALT’s staking rewards have been underwhelming. After more than six months of staking, many holders have received limited airdrops. This lack of reward makes holding and staking $ALT less attractive, especially with other projects offering better returns.

2. Negative Data Trends

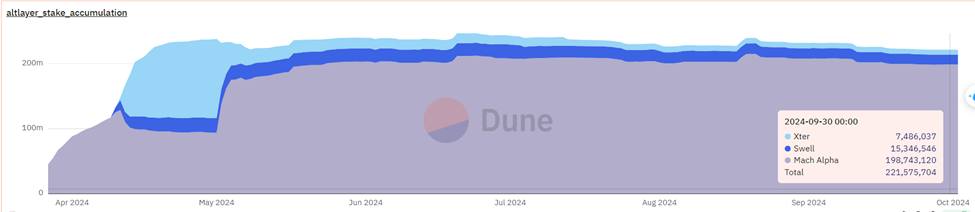

The data for $ALT doesn’t provide much optimism either. For months, the total amount of $ALT staked has seen little growth and has even slightly declined in October. This suggests that some stakers are unstaking and selling their $ALT, reflecting a growing sentiment of disappointment within the community.

Exchange Activity

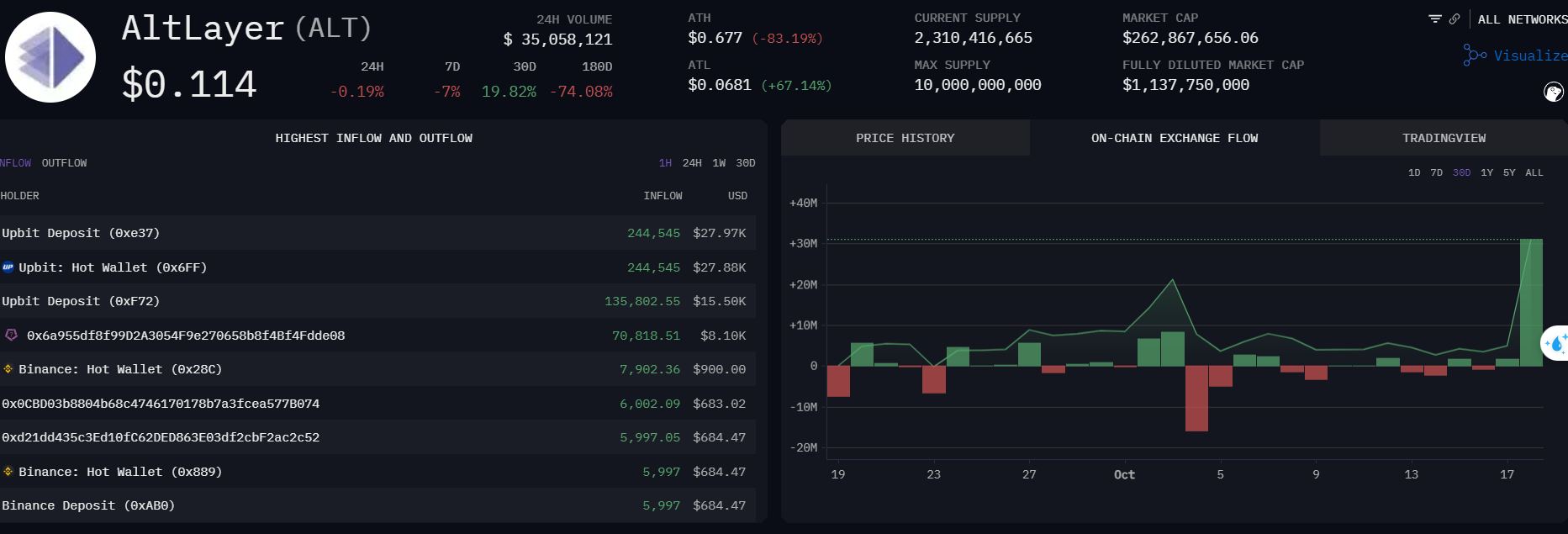

Over the past 30 days, there’s been a noticeable increase in the amount of $ALT being deposited to exchanges, which heavily outweighs the amount being withdrawn to wallets. This signals that many token holders are preparing to sell their assets, creating sell pressure that could further impact the price.

Firechart data on the weekly (W) frame shows that low-volume orders from retail investors are consistently selling, while there’s little evidence of whale buying activity. This suggests a lack of major buyer interest at the current levels, raising concerns about future price support.

3. Tokenomics and Unlocks

The tokenomics of $ALT further complicate the situation. Recently, a large portion of tokens allocated to the team and venture capitalists (VCs) have been unlocked. This creates the potential for significant sell-offs, especially during any price surges, making it harder for $ALT to recover smoothly.

4. Market Maker Sell-offs

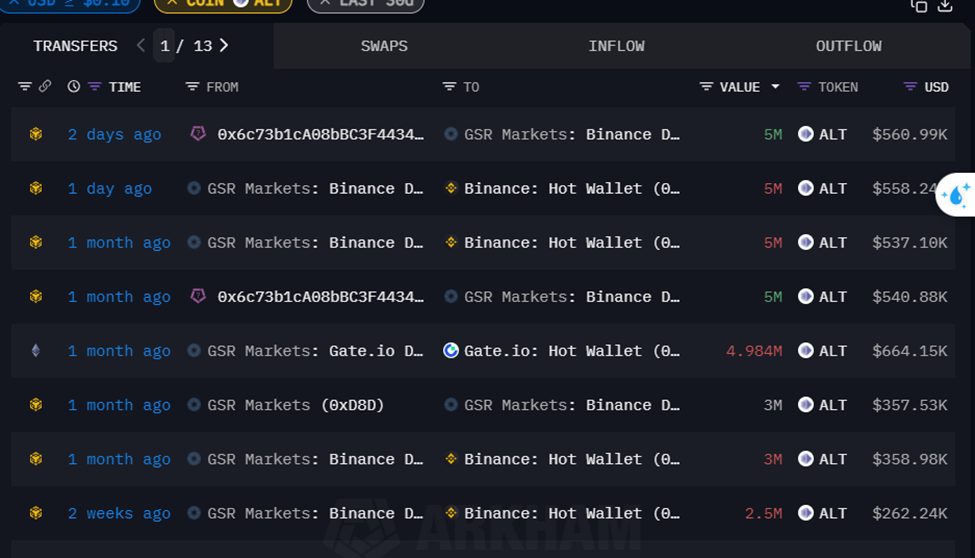

One of the major market makers (MM) for $ALT, GSR Markets, has been showing clear signs of selling activity. On key dates such as September 20 and October 16, GSR Markets deposited significant amounts of $ALT into Binance for selling, coinciding with price rises.

Currently, the main wallet associated with GSR Markets still holds 10M $ALT. This continued selling by a major MM indicates potential downward pressure whenever the price starts to rise.

Conclusion

For investors who bought $ALT at its peak price, the outlook for recovery is challenging. The combination of fading appeal, increased competition, lackluster staking rewards, and signs of market maker sell-offs make it difficult to envision a return to previous highs.

At this stage, restructuring your portfolio might be a wiser move than holding out hope for a miraculous price recovery. Instead of holding onto the belief that $ALT will reclaim its peak, it might be better to take advantage of any price spikes and rebalance your position before sentiment worsens.