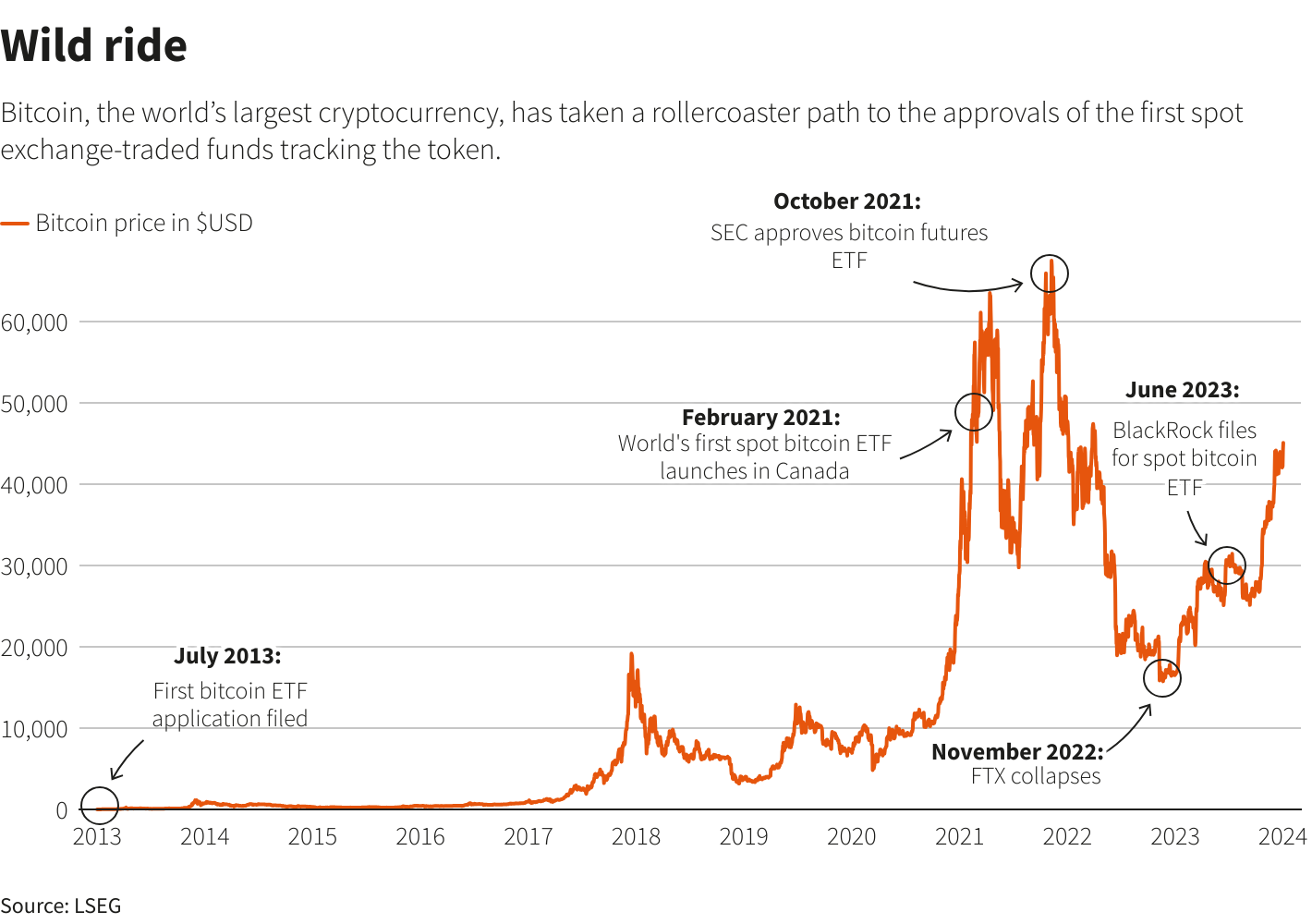

Bitcoin ETFs have been a hot topic of discussion lately, especially as major financial giants push for regulatory approval in the U.S. While they may seem like an exciting opportunity for broader Bitcoin adoption, there are several crucial factors and risks to consider. In this blog, we’ll dive into some fascinating insights about Bitcoin ETFs and how they could impact the crypto market.

1. Wall Street Could Manipulate a $13 Trillion Market

If you think Bitcoin is too big to be manipulated, think again.

In 2020, two senior executives from JP Morgan’s precious metals department were convicted and fined $920 million for manipulating the precious metals market, a market worth around $13 trillion.

The key takeaway here? If a handful of elite traders can manipulate a market that size, Wall Street could easily reshape a $700 billion market like Bitcoin’s market cap.

Remember, BlackRock alone manages over $10 trillion in assets. This means the financial institutions behind Bitcoin ETFs could have considerable influence over Bitcoin’s price movements.

2. 1% of $15.485 Trillion Could Flood Bitcoin

The total assets under management (AUM) of the 10 largest funds currently filing for Bitcoin ETFs amount to $15.485 trillion. What if just 1% of that, or $85 billion, flowed into Bitcoin?

Many may argue, “But Bitcoin’s market cap is $700 billion.”

However, we’re talking about $85 billion in cash entering Bitcoin markets. To put that into perspective, this is equivalent to the entire market cap of USDT, the most widely used stablecoin, and represents about 70% of all stablecoins in existence.

An inflow of this magnitude could create substantial volatility and price movements in the crypto market.

3. 10 Bitcoin Spot ETFs Already Exist

Most people might not realize that Bitcoin Spot ETFs already exist, but they’re based in countries like Canada, Europe, and Brazil. These ETFs haven’t made waves in the global markets because the total assets under management by these providers are relatively small compared to their U.S. counterparts.

However, the approval of Bitcoin ETFs in the U.S.—the world’s largest and most influential financial market—could lead to much greater capital inflows and heightened attention.

4. You Don’t Actually Own Bitcoin with an ETF

One crucial thing to understand about Bitcoin ETFs is that you’re not buying actual Bitcoin. Instead, you own a receipt—essentially a promissory note.

Unlike holding real Bitcoin, which you can trade, stake, or transfer to any wallet, buying an ETF means you’re holding a financial instrument managed by a custodian. The custodian reaps the benefits of staking or lending the Bitcoin behind the scenes.

In the case of BlackRock, for instance, Coinbase may hold some Bitcoin on your behalf. However, there is always the risk of a situation like Sam Bankman-Fried’s FTX, where the custodian could misuse customer funds, engaging in risky behaviors with your assets.

Final Thoughts: Bitcoin ETFs – A Double-Edged Sword?

While Bitcoin ETFs could bring significant amounts of capital into the crypto market, they also come with risks. The custodial nature of these instruments means you don’t have full control over your Bitcoin, and large financial institutions may hold more power over Bitcoin’s price than ever before.

As always, understanding the nuances and risks of new financial products like Bitcoin ETFs is key to making informed investment decisions.

Source: Bitcoin ETFs: Bitcoin ETF Explained – Bringing Bitcoin to the Mainstream