Mantle’s Position in the Market

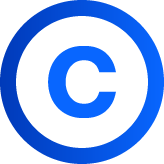

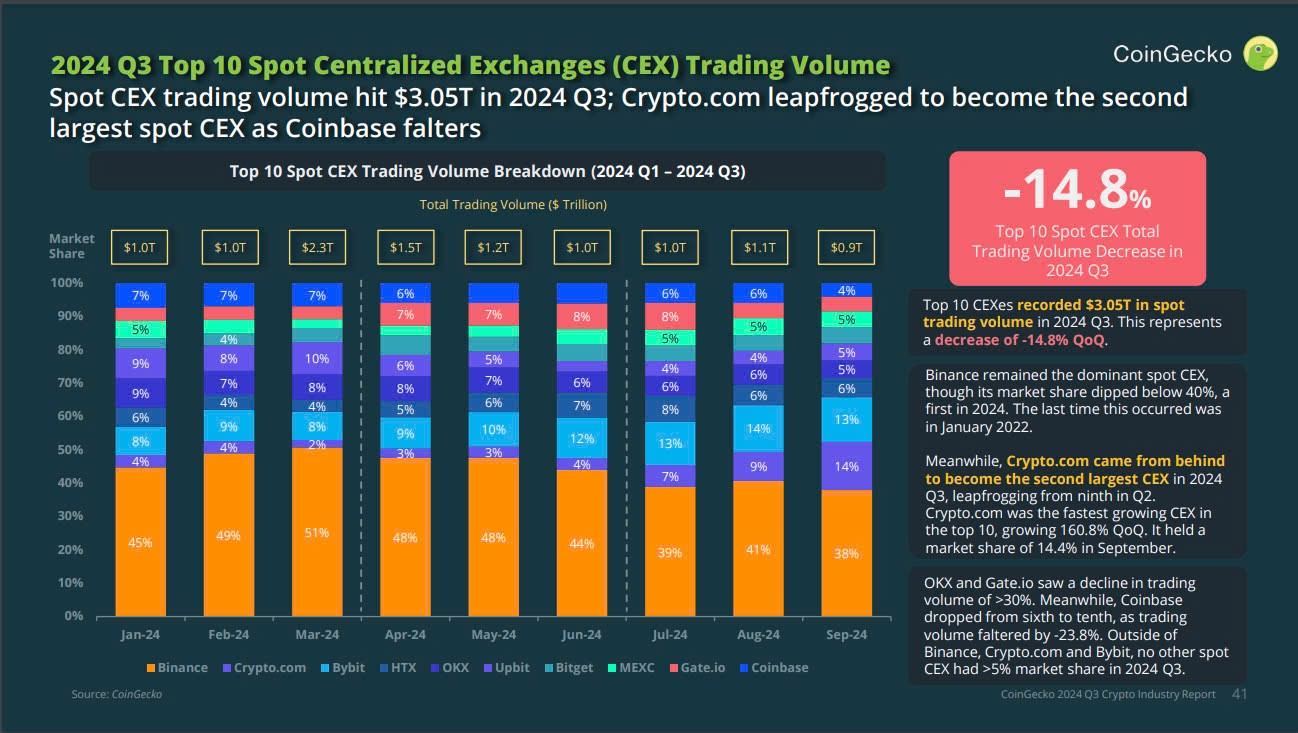

Despite the moderate growth, Bybit, where MNT is actively traded, remains a top contender in the crypto exchange space. Bybit ranks as the 3rd largest CEX in terms of trading volume, following Binance and Crypto.com, capturing 13% market share in September. This demonstrates strong market presence, particularly in spot trading volume.

Furthermore, MNT has gained the attention of Grayscale, which is considering it for future storage and trading options. This recognition could bolster MNT’s credibility as a strong long-term investment.

Ecosystem and Project Developments

Currently, there are 122 projects building on the Mantle network, with 4 new projects added in the last 30 days. The market cap stands at $168.89 billion, showing stability within the Mantle ecosystem, although no significant breakthroughs have occurred, according to Cryptorank.

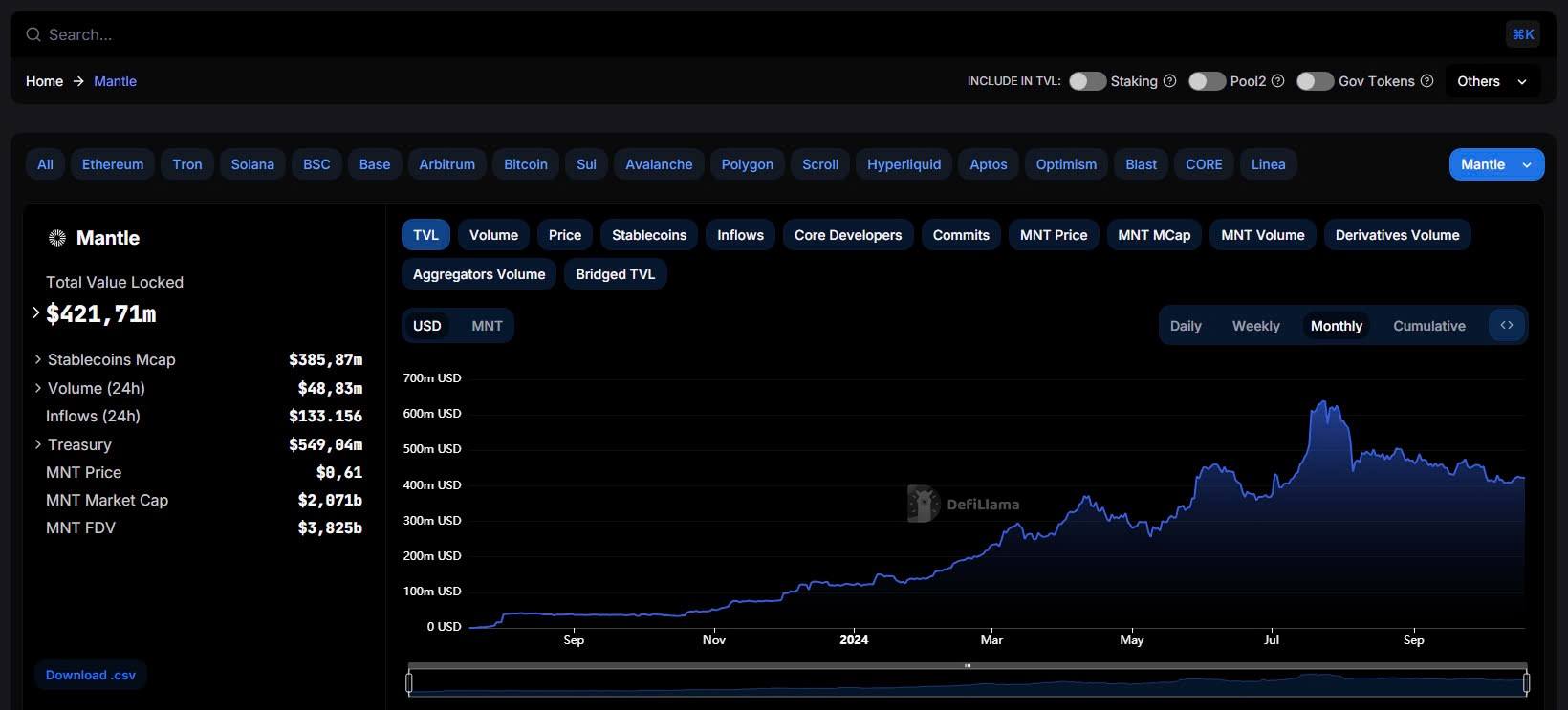

In terms of Total Value Locked (TVL), Mantle saw a slight decrease from $467M to $421M. Over the past month, TVL fluctuated within the $410M – $460M range, keeping Mantle at TOP 13 among EVM-compatible blockchains in terms of TVL.

Trading Volume and Token Holders

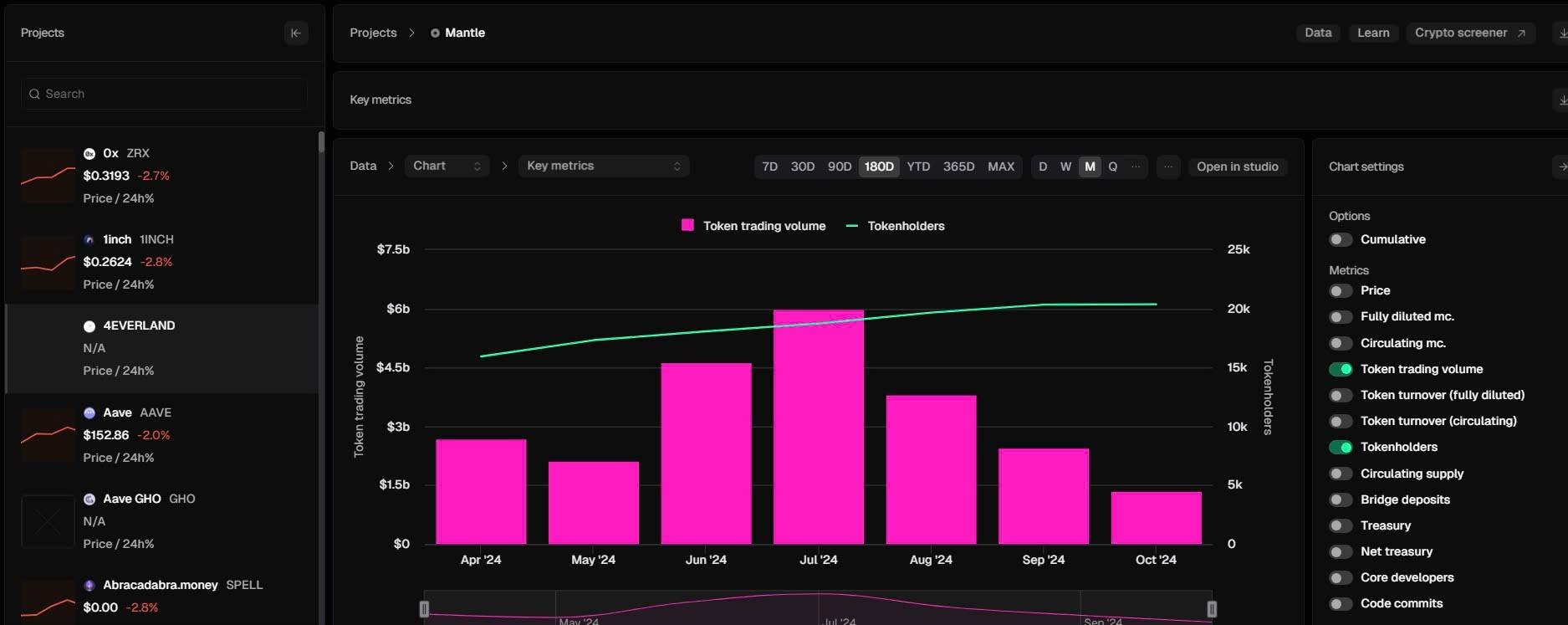

One noticeable shift was the decrease in trading volume for MNT, which fell from $3.804B to $2.465B. Despite this dip, the number of token holders remains steady at 20.4K, indicating strong investor confidence in Mantle, according to data from Token Terminal.

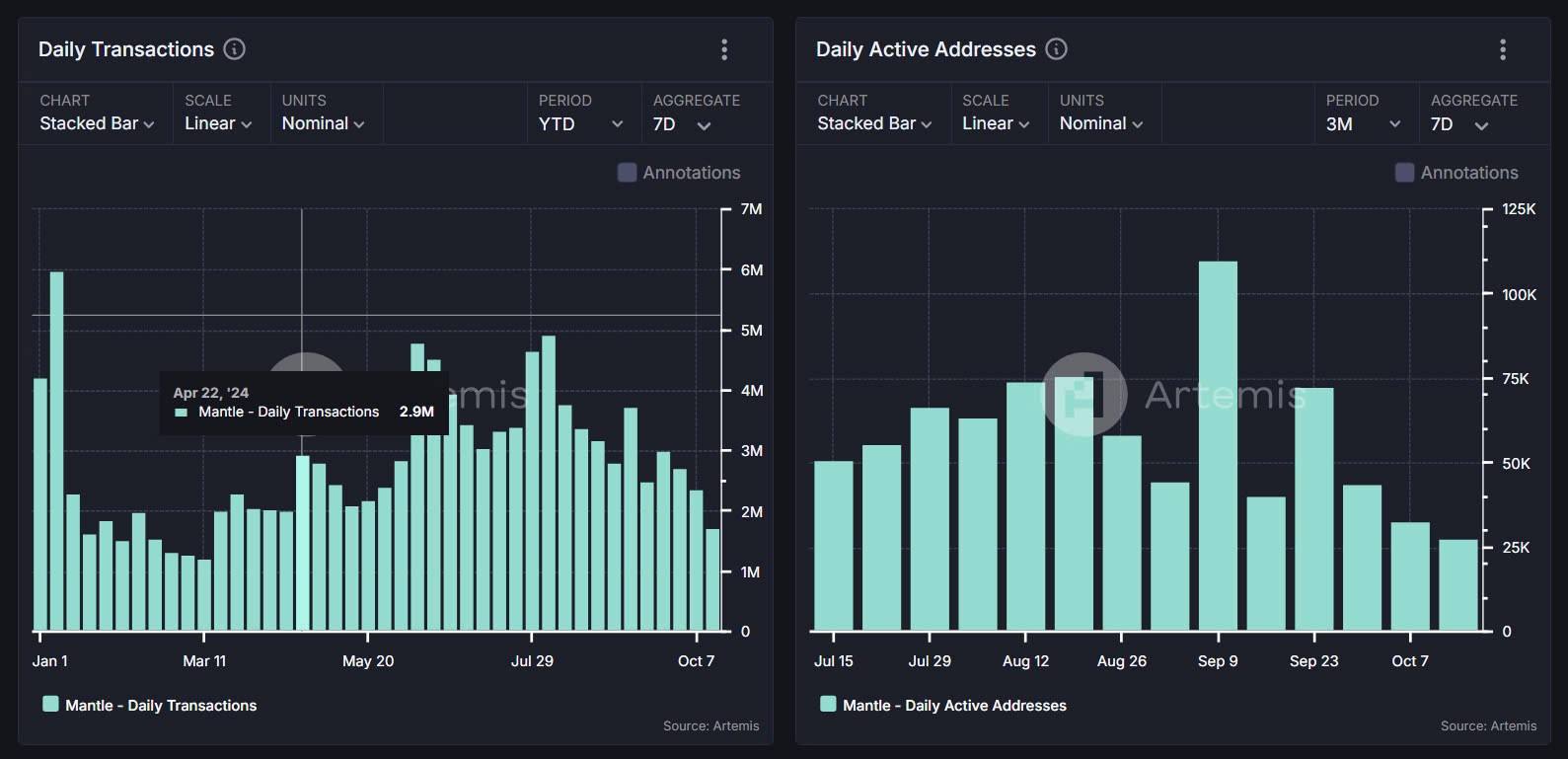

In terms of transactions, Mantle recorded 12.9 million monthly transactions, with 66.1K active addresses, reflecting ongoing positive activity within its user base. Mantle currently ranks as TOP 8 among Layer 2 projects by transaction volume.

Fees and Revenue Performance

However, there has been a significant decline in fees and revenue compared to August. As of September, fees amounted to $152.6K, with revenue dropping to $132.8K. This decline highlights the bearish market sentiment, which has impacted the performance of many projects, including Mantle.

Outlook on MNT Investment

From a personal perspective, holding MNT for multiple use cases such as participating in Bybit’s Launchpad and Launchpool offers appealing benefits. With interest rates of 4% to 6% per month during an uptrend, MNT can generate stable cash flow, beyond just waiting for price appreciation.

In summary, I view MNT as a solid investment for generating consistent passive income while maintaining stability in its ecosystem.